Real estate investment has long been touted as a lucrative path to financial freedom and wealth accumulation. From rental properties to flipping houses, the realm of real estate offers a variety of avenues for generating passive income and building equity over time. However, before diving headfirst into the world of property investment, it’s essential to evaluate whether you’re truly ready to invest in Real Estate. Investing in real estate requires careful consideration, financial preparation, and a solid understanding of the market. So, let’s explore some key factors to help determine if you’re ready to embark on this exciting journey.

Financial Stability:

One of the first questions to ask yourself is whether you’re financially stable enough to invest in real estate. Property investment often requires a significant upfront capital investment, whether it’s for a down payment on a rental property or funds for renovations. Additionally, you’ll need to factor in ongoing expenses such as mortgage payments, property taxes, insurance, maintenance costs, and potential vacancies. Assess your current financial situation, including your income, savings, debt obligations, and credit score. Make sure you have a stable source of income to cover these expenses comfortably without jeopardizing your financial security.

Clear Investment Goals:

Before investing in real estate, it’s crucial to define your investment goals and objectives. Are you looking for long-term appreciation, rental income, or both? Do you want to diversify your investment portfolio or generate passive income streams? Having clear goals will help you determine the type of properties to Invest in Real Estate, the location, and the investment strategy to pursue. Whether you’re aiming for cash flow or capital appreciation, align your investment strategy with your financial goals to maximize returns and minimize risks.

Market Research and Due Diligence:

Successful real estate investment requires thorough market research and due diligence. Familiarize yourself with the local real estate market trends, property values, rental rates, and demand-supply dynamics. Analyze different neighbourhoods and property types to identify potential investment opportunities. Conduct comprehensive property inspections, review financial documents, and assess potential risks before making any investment decisions. Being well-informed and diligent in your research can help you make informed investment choices and mitigate potential pitfalls.

Risk Tolerance and Patience:

Real estate investment, like any other form of investment, comes with its own set of risks and uncertainties. Property values can fluctuate, rental markets can change, and unexpected expenses may arise. Assess your risk tolerance and ability to withstand market fluctuations and unforeseen challenges. Additionally, understand that real estate investment is a long-term commitment that requires patience and perseverance. It may take time to see significant returns on your investment, so be prepared for the journey ahead and avoid making impulsive decisions based on short-term market fluctuations.

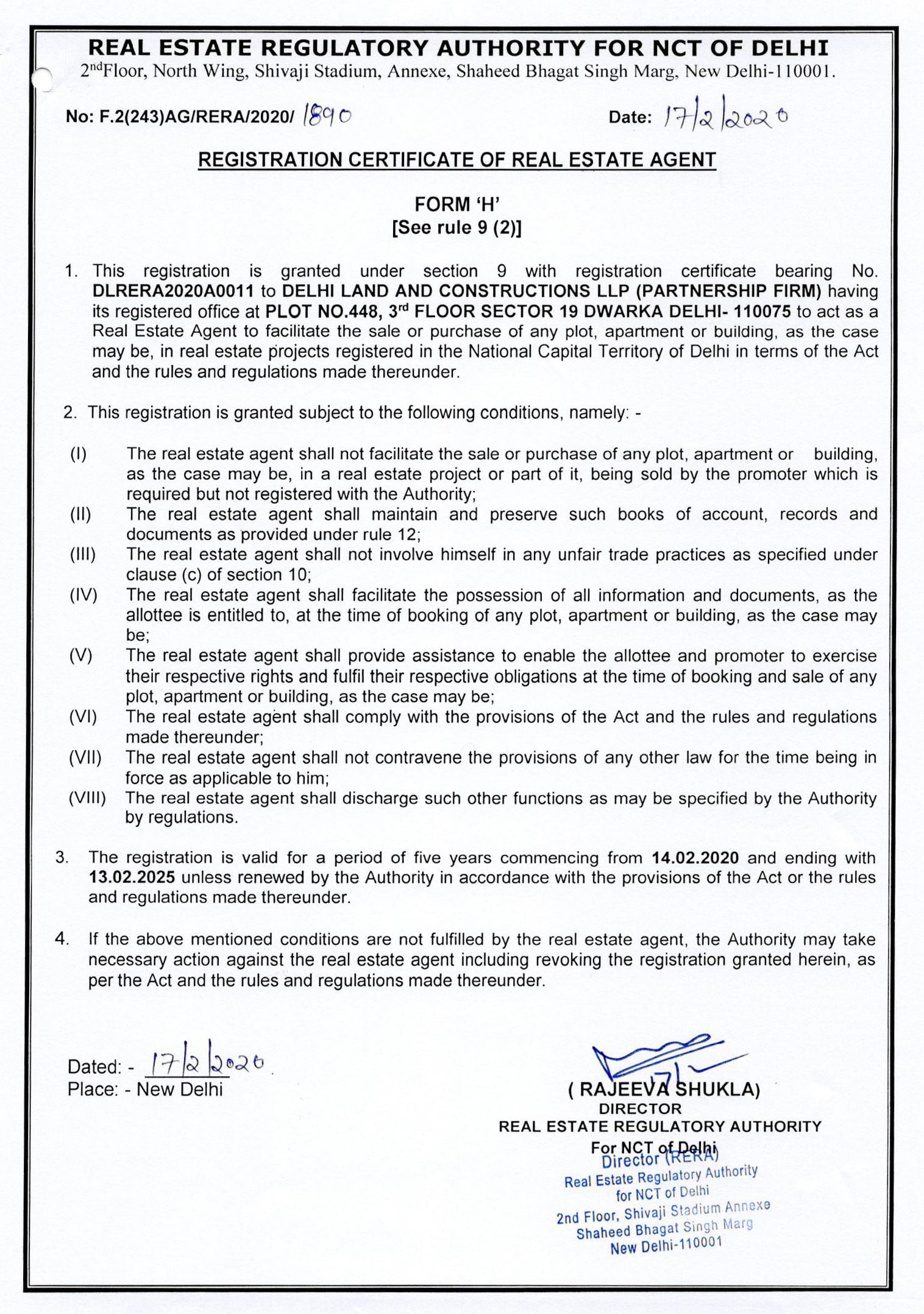

Legal and Regulatory Considerations:

Investing in real estate involves navigating various legal and regulatory requirements, including property laws, zoning regulations, landlord-tenant laws, and tax implications. Make sure you understand the legal and regulatory framework governing real estate investment in your area. Consider consulting with legal and financial professionals to ensure compliance and mitigate legal risks associated with property investment.

In conclusion, invest in real estate can be a rewarding endeavour, but it’s essential to assess your readiness and preparedness before taking the plunge. By evaluating your financial stability, defining clear investment goals, conducting thorough market research, understanding your risk tolerance, and navigating legal considerations, you can determine whether you’re ready to embark on the journey of real estate investment. Remember, patience, diligence, and informed decision-making are key to success in the dynamic world of real estate investment.