How to Financially Preapre to Buy your First Home?

Long gone are those days when you have to get settled financially and personally to buy a home. Nowadays, people say it is wise to start early when it comes to massive investment in life or buy your first home. Purchasing a home early comes with certain advantages. You can very well use it as a source of additional income if you rent it out.

However, first-time home buyers find difficulty in purchasing a new abode. It is so because buying one is a stressful job. But if you prepare yourself enough, you can buy your coveted house, apply for a mortgage, and in the end, close the deal with confidence.

So, you might be wondering how to prepare well, right? To know the ways, you need to go through the below segment. Below we have mentioned a checklist helping you prepare better, and you can buy your dream home without much hindrance. Hence, let us check out the below points without further delay.

- Determine your budget: The first thing you should do before buy your first home is to ensure you have set a proper budget. It is crucial as investing your hard-earned money in a new abode is a huge decision. As a result, if you choose a house beyond your capacity, you cannot buy it. Besides, if you purchase it, you have to seek some extra capital in the form of a mortgage loan, and you also need to make monthly repayments with interest which is hectic. That is why it is always wise to prepare an estimate and then go for your dream abode.

- Do some digging: Before you own your home, you should do some research. It means you need to determine the place, its surroundings, number of bedrooms, and many other things to get the best one. Knowing this information means you will know what you want and how much to save. Therefore, consider this point while purchasing a new home.

- Save some cash: While planning to buy your first home, you should save some extra capital for the down payment and many other expenses. Remember that you will have to pay EMIs every month if you take out a loan. Besides, if you sell your previous house and are currently living on rent, you also need to pay for it. That is why it is quite imperative to set aside some money each month for these expenses.

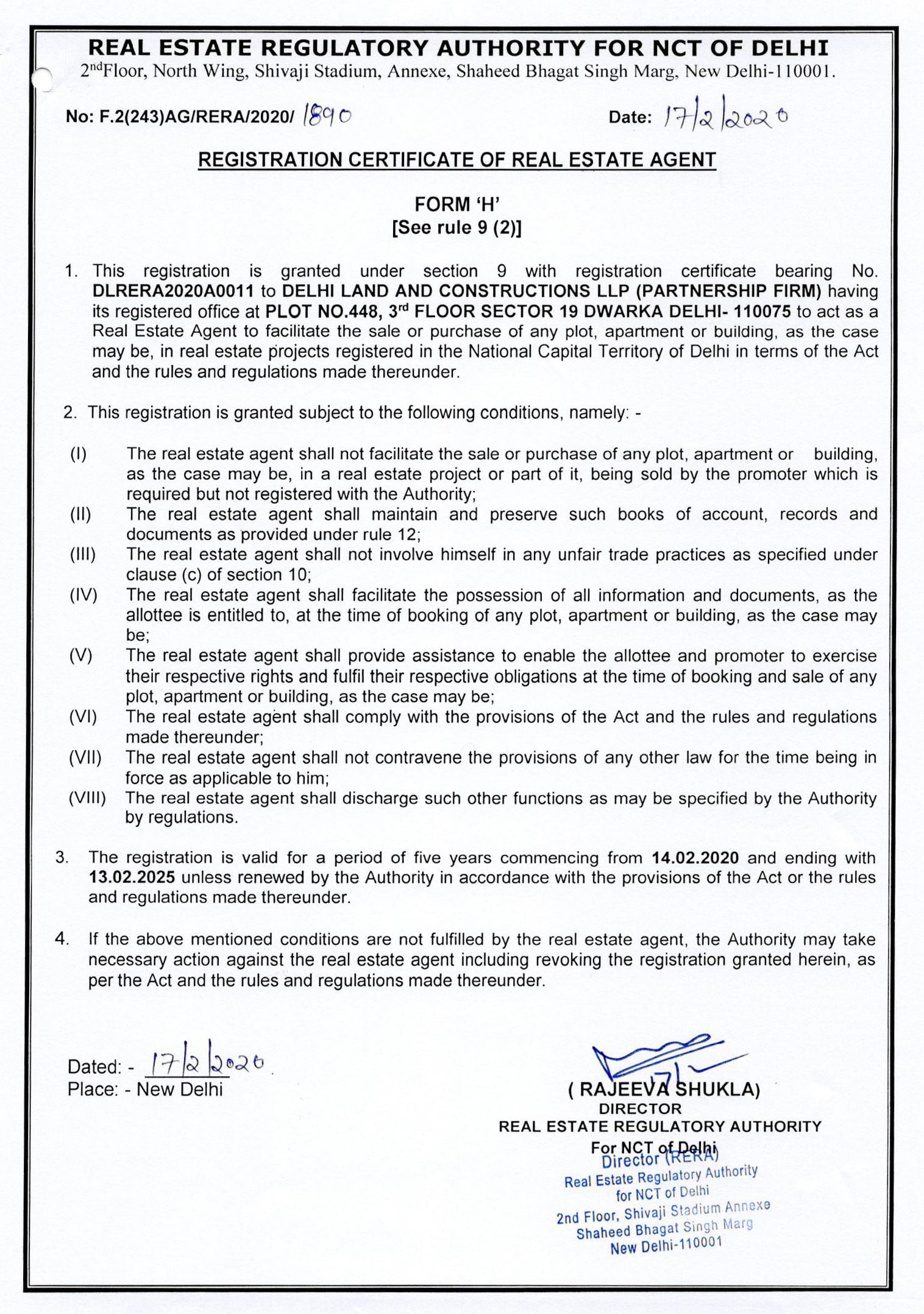

- Organize all the documents: Many first-time homebuyers often made the mistake of not gathering all the required documents in one place. It is not a correct approach, and you should never follow as you have to submit papers like bank statements, copies of tax returns, pay stubs, and others. Hence, always organize the papers in one place before buying a new home.

- Compare home loans: Apart from the above, you should compare home loans before buy your first home. While doing so, you will notice many types of interest rates available. As a result, if you compare it carefully, you might get the most affordable rate with flexible repayment terms and conditions. Hence, it is another tip that will help you prepare yourself better.

Final Verdict

To conclude, we can say that buying your first home is an enormous and crucial investment. Without much proper planning, you will end up in a fiasco, and you also have to face many issues. And for this reason, it is always advisable to consider the above tips or tricks and abide by those while purchasing your dream abode.