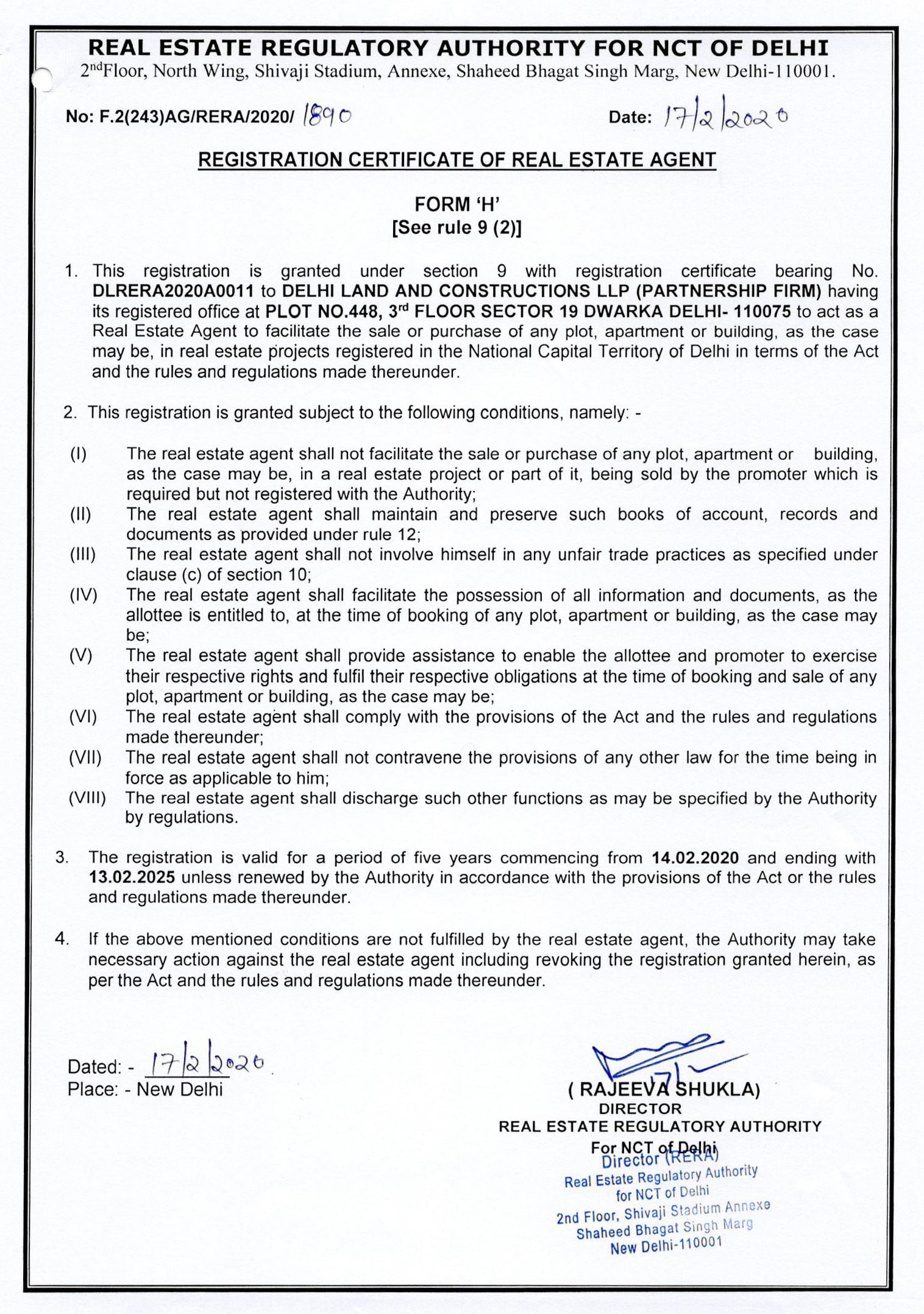

Should I sell my property now? purchase a new one? or hold the existing property? are some of the frequently asked questions as people get confused about these. Unfortunately, there is no clear answer for these because the right reply to these questions depends on some market conditions, updates and real estate trends. Therefore, you need to concentrate on some particular aspects with a strategic approach to getting what you want.

As property investment requires a proper and clear strategy, you must contemplate multiple factors before making any decision. Firstly, you need to check with yourself a few questions to decide whether selling, buying, or holding properties is the best strategy or not. Besides, you can consider the below pros and cons that will help you determine the correct approach. So, let us review the below section to get a clear idea.

Pros

- Ongoing income : Property investment generates regular income. You will earn money regardless of where you are and what you are doing. Purchasing and holding it can be a source of your passive income. Therefore, if you hold your building, you can get benefits in the long run. With each passing day, the amount of land is increasing. So, having a property is always helpful to get profit.

- Boost your property value : There is no best time to sell your property because the longer you have possession over your foundation, the more you are to avail yourself of inflation. As a result, it will increase your property value. Besides, the borrowed mortgage amount also decreases as you repay it off. Therefore, you will get a decent return on your investment in the end.

- Tax benefits : Suppose you have a property for several years, and you cannot decide whether to sell or hold it. You might wonder, is it the right time to sell your real estate property? Well, with a rental property, you can avail of tax advantages. You have to pay lower tax rates if you owe one. Besides, you can also write off expenses, including maintenance and repair costs.

Cons

- Vacancy Costs : You have a property that creates more harm than good as you cannot find any tenants. If your property remains empty for months or years, you have to cover the mortgage during the entire period. Hence, before investing, ensure that your budget will cover the mortgage amount for a few months of vacancy per year. It is a chief drawback of buying and holding a property.

- Responsibilities and legal concerns : If you are a newcomer in the rental property investment field, you might not be well-accustomed to management and legal matters. It requires specific skills, and the method of getting tenants and meeting their requirements can be a daunting and time-consuming task. As a result, if you cannot manage all these, you can sell your property.

Conclusion

So, now you can decide whether you should Buy Sell or Hold your property considering the above pros and cons. Remember, with the best real estate exit strategy, you can get multiple advantages and make decisions quickly and efficiently. Hence, choose wisely and get a peaceful life.