Real estate investing is a highly competitive market, and every investor knows that location is one of the most important factors to consider when making investment decisions. In fact, the importance of location in real estate investing cannot be overstated. A great location can mean the difference between a successful investment and a financial disaster. This article will explore the importance of location in real estate investing and provide tips for finding the best locations for your investment.

Affects the Value of a Property

First and foremost, location is important because it directly affects the value of a property. Properties in prime locations typically have higher values than those in less desirable areas. For example, a property in a highly sought-after neighborhood in a major city will generally be more expensive than a property in a rural area or a less popular neighborhood. This is because properties in prime locations are in high demand and there is a limited supply, driving up prices.

The Potential Income

Moreover, location is critical because it affects the property’s potential for rental income. Rental properties that are located in areas with high demand for rental units can command higher rents and have lower vacancy rates. Therefore, investors who invest in properties in prime locations can expect to see higher rental income and stronger rental demand.

Another factor to consider is the future potential of a location. Real estate investing is a long-term game, and investors must consider the future potential of a location when making investment decisions. For example, an area that is currently less popular or less developed may have great potential for future growth and appreciation. Investors who have a long-term outlook and can identify areas that are poised for growth can reap significant benefits over time.

The Quality of Life

In addition, location can also affect the quality of life for residents or tenants. Properties in desirable locations are often close to amenities such as shopping centers, restaurants, schools, and public transportation. These amenities can make life more convenient and enjoyable for residents, which can increase the appeal of the property and its potential for rental income.

However, it’s worth noting that a great location doesn’t guarantee a successful investment. It’s essential to do your due diligence and conduct thorough research before making any investment decisions. For example, you should assess the condition of the property and the potential costs of any necessary repairs or renovations. Additionally, you should consider the local market conditions and factors such as job growth, population trends, and rental demand.

How to find the best location?

So, how do you find the best locations for real estate investing? Here are some tips:

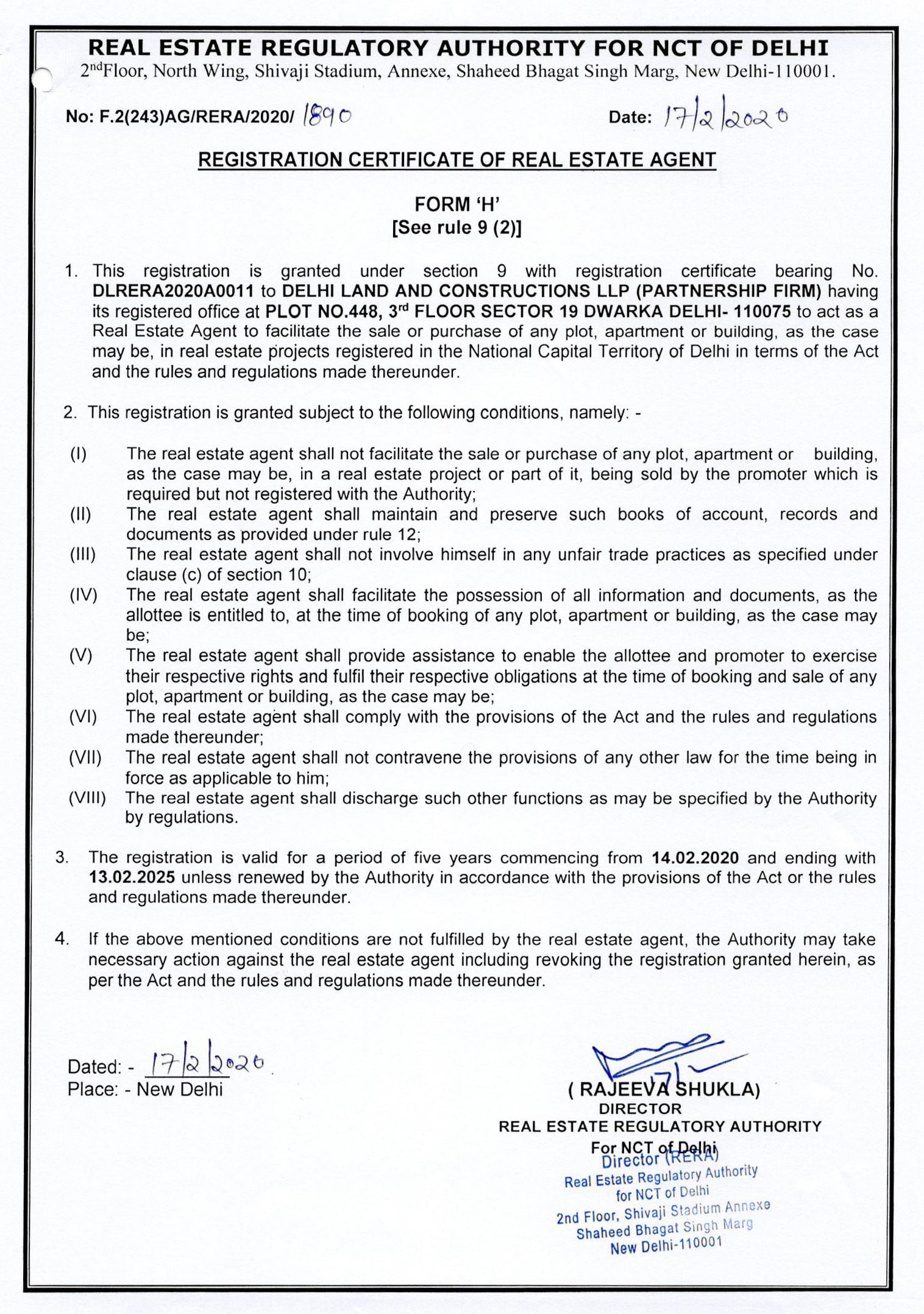

Research local market trends and conditions: Before investing in any property, it’s essential to understand the local market conditions. This includes factors such as population trends, job growth, rental demand, and local economic conditions. You can use online resources or consult with a local real estate agent to get a better understanding of the local market.

Look for areas with potential for growth: As mentioned earlier, future potential is a critical factor in real estate investing. Look for areas that are poised for growth or development, such as those undergoing revitalization or urbanization projects. These areas may offer significant potential for appreciation over the long term.

Consider proximity to amenities: Properties that are close to amenities such as schools, shopping centers, public transportation, and parks are often more desirable for renters or buyers. Consider the proximity of the property to these amenities when making investment decisions.

Assess the condition of the property: It’s important to assess the condition of the property and the potential costs of any necessary repairs or renovations. This will help you determine the true value of the property and whether it’s a worthwhile investment.

Consult with a real estate professional: Finally, it’s always a good idea to consult with a real estate professional when making investment decisions. A local real estate agent can provide valuable insights into the local market and help you make informed investment decisions.

In conclusion, the importance of location in real estate investing cannot be overstated.